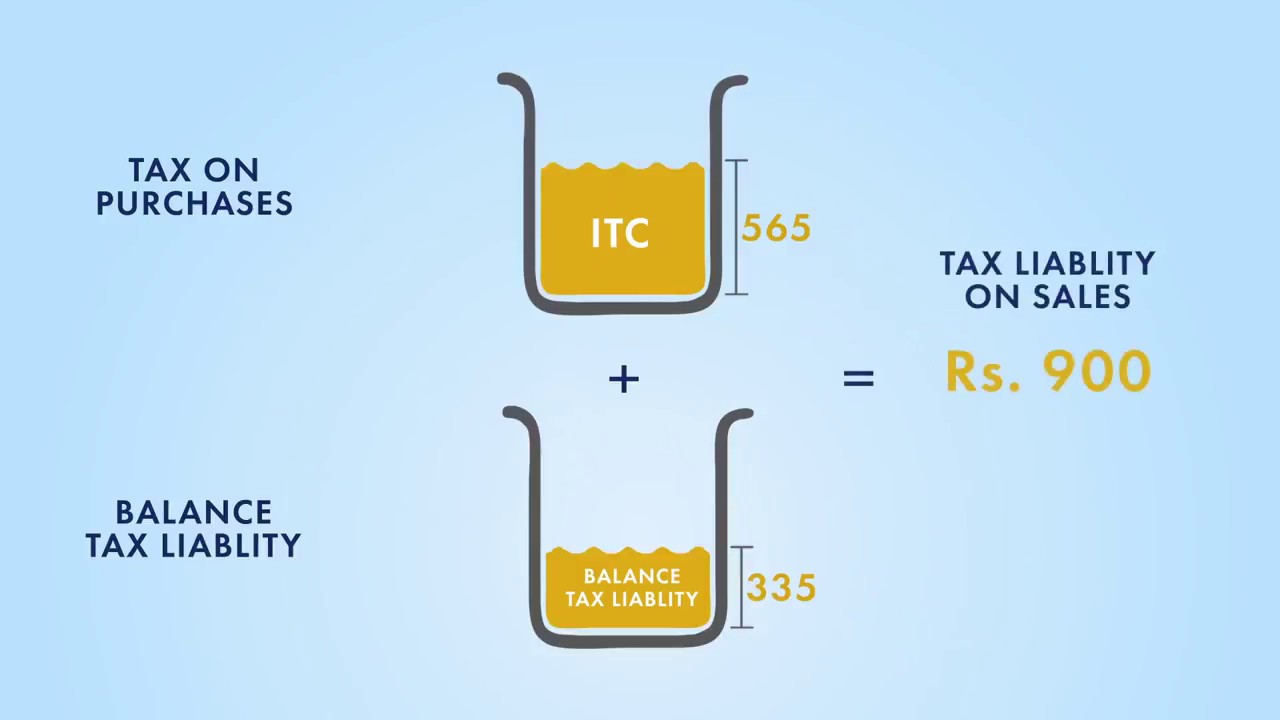

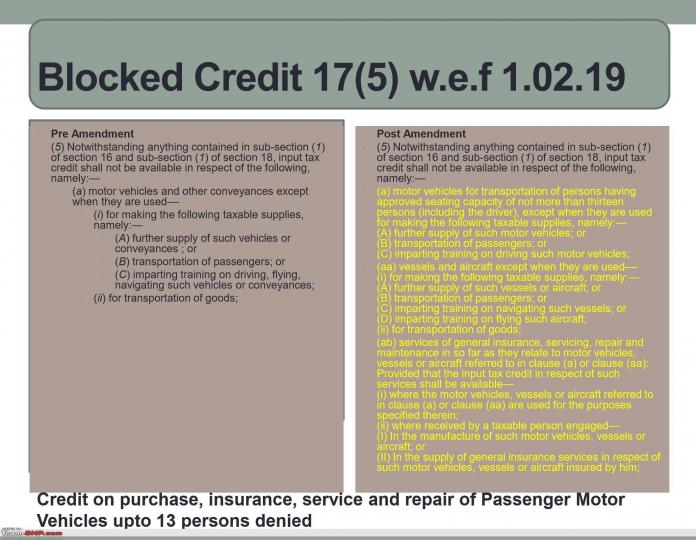

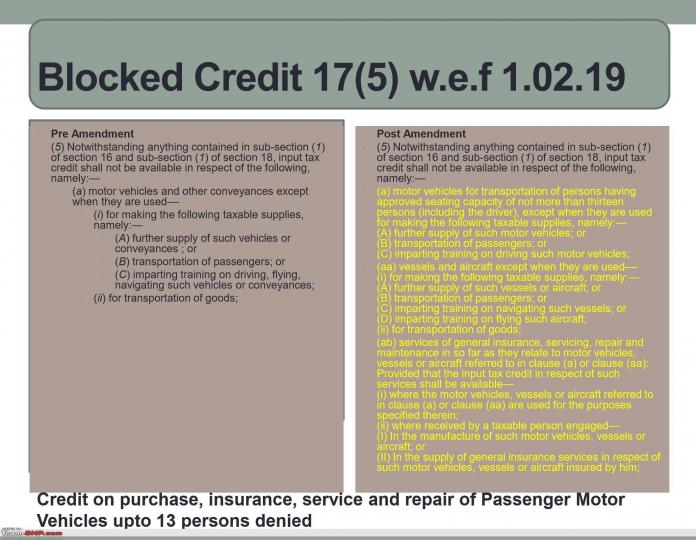

1 Executive Summary. As per section 175 of CGST Act 2017 there are certain input services such as health services life insurance and health insurance renting or hiring of motor vehicles which are under the blocked category and the service recipient of these services cannot availed and utilised against set-off Output liabilityConsidering the current situation of.

How Gst Input Tax Credit Works Youtube

14 Blocked Input Tax Credit ITC under GST Exemption from GST on Insurance schemes.

. Profiteering - construction service supplied by the Respondent - it is alleged that the Respondent had not passed on the benefit of input tax credit to him by way of commensurate reduction in the price - Since there was no basis for comparison of ITC available before and after 01072017 the Respondent was not required to recalibrate the price of the flat due to. Motor Vehicle and other conveyance Vessel and Aircraft. Manner of distribution of credit by Input Service Distributor.

Janashree Bima Yojana JBY Aam Aadmi Bima Yojana AABY. It is an Indirect tax which introduced to replacing a host of other Indirect taxes such as value added tax service tax purchase tax excise duty and so onGST levied on the. What is GST how it works.

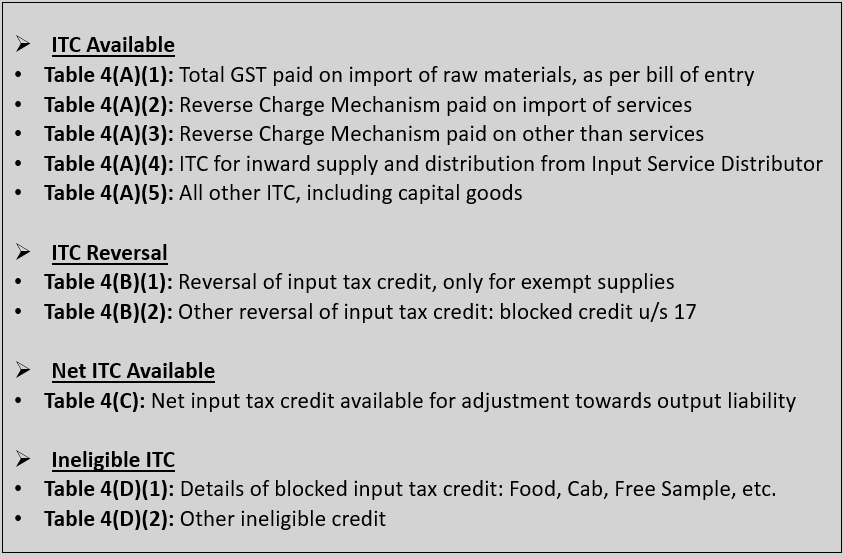

Life insurance provided by Government schemes are exempted from GST under. There are following insurance schemes on which GST is exempted. A brief list where input tax credit under GST is not available Section 175 There are some cases where there is no input available under GST to the applicant and there are some exceptions to this hence to know more about this please read carefully the whole article.

Taking input tax credit in respect of inputs and capital goods sent for job work. GST department cannot cancel registration of taxpayer on the ground that receptionist of t. Apportionment of credit and blocked credits.

GST stands for Goods and Services Tax.

Overview On Input Tax Credit Under Gst Law Passed On 27th March 2017

Ineligible Itc Under Gst Complete List With Example

No More Input Tax Credit On Automotive Invoices Team Bhp

Restrictions On Input Tax Credit Us 17 5 Under Gst Blocked Credits Under Gst Youtube

Input Tax Credit Under Gst Goods And Service Tax Simple Tax India

Gst Input Tax Credit Blocked Credits Taxmann

Eligibility Conditions For Taking Input Tax Credit Under Gst By Sn Panigrahi Youtube

No More Input Tax Credit On Automotive Invoices Team Bhp

Gst Blocked Input Tax Gabrieltrf

Input Tax Credit And Its Nuances Under The Gst Law Novello Advisors

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

Ineligible Input Tax Credit Or Block Credits Under Gst

Cbic Asks Gst Officers To Block Itc Only On Basis Of Evidence Not Suspicion The Financial Express

What Is Input Credit Itc Under Gst

An Overview Of Blocked Itc Under Gst Corpbiz Advisors

When Gst Input Tax Credit Will Be Blocked From Electronic Credit Ledger Youtube

Apportionment Of Credit And Blocked Credit Under Gst

A Complete Guide To Input Tax Credit Itc Under Gst

Expenses For Which You Cannot Claim Itc Credit Under Gst